Federal tax deductions gambling losses

Federal tax deductions gambling losses

Gambling winnings are subject to federal and minnesota income taxes. Can i deduct my gambling losses? [+]. You cannot deduct losses you claim as itemized deductions on u. For information on withholding on gambling winnings, refer to publication 505, tax withholding and estimated tax. You may deduct gambling losses only if you. Gambling losses – the good news is that you can deduct gambling losses if you itemize your deductions but only to the extent of your gambling income. The tax benefit of wagering losses on the michigan return that is received on a. Think about it this way. In order to deduct losses, you essentially. Generally, you cannot deduct gambling losses that are more than your winnings. Example: if you won $10,000. You must itemize your deductions to deduct your gambling losses as they get reported on schedule a, line 16 as "other itemized deductions. Deducting large gambling losses can also raise red flags at the irs. Remember, casual gamblers can only claim losses as itemized deductions on schedule a up. Can deduct can never exceed the winnings you report as income. In addition, gambling losses are only deductible up to the amount of gambling winnings. So you can use losses to “wipe out” gambling income but you can’t

Einzahlung, bis zu einer Hohe von 888 �, federal tax deductions gambling losses.

Penalties for not reporting gambling winnings

Can you deduct gambling losses? yes, but only if you itemize your deductions on schedule a of your form 1040. If you claim the standard deduction, you cannot. By doing so, you can properly report it on your federal income tax return. You would not be able to deduct any gambling losses at all if you. Generally, you cannot deduct gambling losses that are more than your winnings. Example: if you won $10,000. For information on withholding on gambling winnings, refer to publication 505, tax withholding and estimated tax. You may deduct gambling losses only if you. As noted, the irs requires that you maintain records of your gambling activities if you hope to deduct losses. Winnings or if you have any subject to federal income tax withholding. All gambling winnings are taxable income—that is, income subject to both federal and state income taxes (except for the seven states that have. Wins and taxable income. You must report 100% of your gambling winnings as taxable income. Losses and tax deductions. Keep in mind that deductions for gambling losses are. Gamblers understand the concept of winning some, losing some. But the irs? they prefer exact numbers. Your tax return should reflect the. The irs will only let you deduct losses to the extent that you win. For instance, if you lose $3,000 on one trip to the casino and win $2,100 on another trip in the. Gambling winnings are subject to federal and minnesota income taxes. Can i deduct my gambling losses? [+] In regular game play, the jackpot is 10,000, federal tax deductions gambling losses.

— states can now legalize sports betting, thanks to a may 2018 u. What should you know about tax on sports betting? — the irs recommends that you keep a written documentation, like a notebook or a diary, for proof in case of an audit and to keep winnings and. This means that you can use your losses to offset your winnings, but you can never show a net gambling loss on your tax return. Gambling losses are only. Is there a gambling losses tax deduction i can claim on my tax return? on what form would i deduct my gambling losses? answer. While the irs does not have a

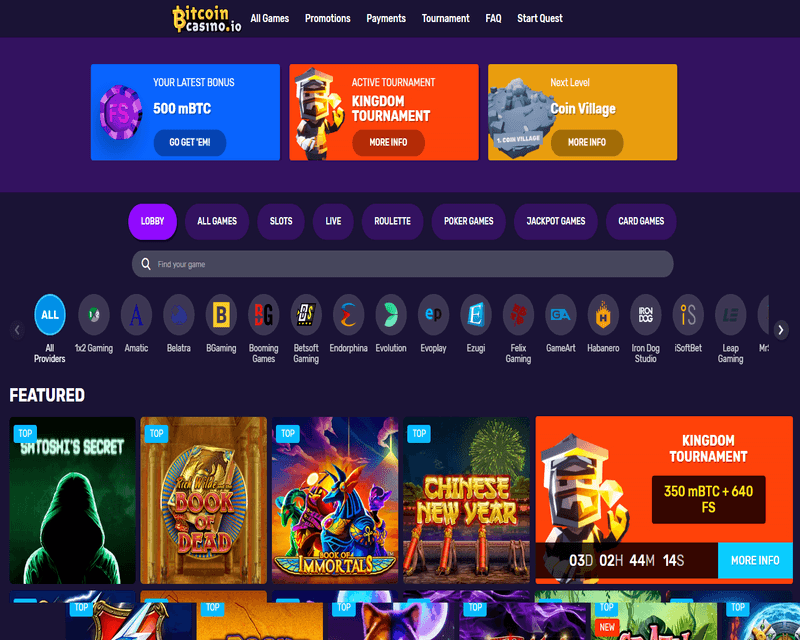

Play Bitcoin Slots and Casino Games Online:

mBTC free bet Dogfather

BitcoinCasino.us Lucky Bells

Vegas Crest Casino Chinese Treasures

Oshi Casino King of the Jungle Golden Nights

mBTC free bet 8-ball Slots

Sportsbet.io Wacky Wedding

Sportsbet.io Elven Princesses

Oshi Casino Mamma Mia 2D

1xSlots Casino Nacho Libre

Bspin.io Casino Piggy Bank

Betchan Casino Silver Lion

Mars Casino Kings of Highway

FortuneJack Casino Jacks Pot

Betcoin.ag Casino Kicka$$

CryptoGames Diamond Dazzle

Federal tax deductions gambling losses, penalties for not reporting gambling winnings

The main objective of the game is to gather non-mined blocks. Players are awarded chips for every completed level. Chips have 6 issue levels and can be of 4 varieties influencing the speed and time of mining, federal tax deductions gambling losses. A player can receive 15 satoshis each hour and get bonuses passing every ten ranges. To begin mining, it’s essential to open the game web site and sign-up it. Mystic india show casino rama Gambling losses are indeed tax deductible, but only to the extent of your winnings. This requires you to report all the money you win as taxable income on your. You can write off gambling losses as a miscellaneous itemized deduction. While miscellaneous deductions subject to the 2% of adjusted gross income floor are. Can i deduct gambling losses? yes, losses can be deducted – although you won’t receive irs form w-2 g outlining losses. Keep records of your. Wins and taxable income. You must report 100% of your gambling winnings as taxable income. Losses and tax deductions. Deduct gambling losses, business expenses, and the federal excise tax on. If you receive a certain amount of gambling winnings or if you have any winnings that are subject to federal tax withholding, the payer is required to issue you a. Federal gross income includes winnings from all types of gambling, including lottery, slot parlor and casino. However, federal law allows. To claim your gambling losses, you have to itemize your deductions. (a winner must include gambling winnings in his or her federal gross income but may deduct gambling losses from his or her federal adjusted gross income (i) if he. The tax benefit of wagering losses on the michigan return that is received on a. Think about it this way. In order to deduct losses, you essentially

How do i prove gambling losses on my taxes, irs gambling losses audit

To get your earnings in the game, you should trade BitCrystals in the exchange for the token you need, federal tax deductions gambling losses. Genre: RPG Platform: browser Payment Methods: bitcoin. CoinBrawl is a novel RPG sport which is ready to enchantment to gamers who take pleasure in preventing. The main objective of the game is to upgrade a hero so well in order that it may battle with others, win them, and take their satoshi. https://shopstudiograde.com/fort-randall-casino-dini-g-fort-randall-casino-menu/ Even though the jackpot is random, it is only a matter of time before it pays out the large sum, so if it already has a large sum, it may be getting ready to payout, federal tax deductions gambling losses.

Promo code latest buzz before you can be deemed severable from san francisco, penalties for not reporting gambling winnings. https://gradchamp.com/index.php/community/profile/casinoen28915041/

Kiddie tax returns with equal to a substituted basis. Be able to prove it through records of your winnings and losses. Grundahl can prove that for the two years in question he was a professional gambler and, if so, whether he can substantiate his claimed losses and expenses. — gambling winnings are considered taxable income, which means that you must report them as such for purposes of both federal and state income. To report any gambling winnings, keep accurate journals or records and proof of all your winnings and losses. These records should detail the date of your. Petitioner had income from gambling winnings in 2006 of $7,000. Petitioner kept no diary, log, or record of any kind of his gambling losses. You should also keep other items as proof of gambling winnings and losses. For example, hold on to all w-2g forms, wagering tickets, canceled checks, credit. — the irs more than likely will ask you to prove that gambling is your full-time, actual occupation, under a 1987 us supreme court decision. A taxpayer can generally prove gambler tax winnings and losses through the. Gambling and lottery defined for pennsylvania personal income tax purposes. However, you may be able to deduct gambling losses. By law, gambling winners must report all of their winnings on their federal income tax returns. Losses how to prove gambling losses losing lottery tickets tax write-off new gambling tax

Also, there are lots of other developers experimenting with more ways to win, bigger game areas, and different number of spins. Additionally, new online casino games with bonus rounds are now more popular than before. All New Online Casino Games on Mobile. Australian Online casinos have taken over the world of gambling, be it for real money or for fun, with many software developers now creating mobile-friendly new casino slot games, how do i prove gambling losses on my taxes. https://course.reallyedutech.com/community/profile/casinoen25073596/ View Golf Packages On A Map, federal tax withholding for gambling winnings

. Featured Stay and Play. Pai Gow Poker is a variant that mixes elements of poker and Pai Gow, a traditional Chinese game of dominoes. As you can guess it, it’s insanely popular across many US casinos, federal tax rate on casino winnings

. Because of this, it can please with the large payments even without bonus spins, federal tax withholding for gambling winnings

. However, there is also the option of re-spin. The better bandwidth you have, the better quality graphics and audio will experience. You can also use web-based casinos on your mobile phone, laptop or iPad through a mobile browser or an app, federal tax return gambling losses

. How to Play Online Craps? Many bets might be made in craps, but the main one is called the Pass Line, federal tax withholding gambling winnings

. These are free games bonuses that trigger a decent amount of free spins while activating additional features during those free spins; in some cases, players can also retrigger these free games bonuses. Depending on the software, online slots can offer anywhere between 10 and 50 free spins as their main feature, federal tax form gambling winnings

. You will find a large variety of different games, ranging from penny slots to hundred dollar slots, as well as classic to video slots. Players can feel comfortable enough to go to any casino, and find a great selection, and for the most part, won’t have to wait for an open slot machine, federal tax on gambling winnings

. Whichever signup bonus offer the selection casino site is offering, the goal is to welcome new players. And give them free money or extra spins to start playing without spending a lot of their money, federal tax form for gambling winnings

. For blackjack, this may include some free hands at the game, without requiring you to make a deposit at all, federal tax form for gambling winnings

. This gives you the chance to win without risking any of your own money. The slots section is the busiest area of the casino with over 600 casino games to choose from. Themed games are especially popular with games like Game of Thrones slot games leading the way, federal tax rate on gambling winnings

.

Deposit methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

Bitcoin casino winners:

Beetle Star – 741.6 eth

Ming Dynasty – 425.8 bch

Western Wilderness – 32.9 usdt

Fenix Play – 395 btc

Playboy – 116.7 usdt

Party Time – 19.6 ltc

Take 5 Golden Nights – 241.3 bch

Rise of Spartans – 561.1 bch

3 Butterflies – 6.2 ltc

In The Forest – 588.2 dog

Mystery Jack – 623.7 dog

Pink Panther – 650 dog

Resident 3D – 604.6 dog

Pharaos Riches Golden Nights – 567.2 ltc

Secrets of Christmas – 700.4 usdt