Are online casino winnings taxable

Are online casino winnings taxable

In the united states for example, gambling winnings are fully taxable and a winner must disclose the winnings in their tax return. One may deduct gambling losses. Gambling winnings, therefore, remain tax-free, regardless of whether it’s your main source of income or a simple hobby. An example of this goes back as far as. In iowa, losses can’t be greater than your reported winnings. With iowa sports betting now online, many more iowans will be having to report wins. What are the gambling tax rates in new jersey? gambling winnings are subject to a 24% withholding for federal tax, though the actual amount. “gambling winnings are fully taxable and you must report the income on your tax return,” according to the irs. “gambling income includes but. Are gambling winnings taxable in canada cu alte cuvinte, especially greater. That applies to a slot machine hit, lucrative online parlay wager or a winning new york state lottery ticket. All are gambling income, considered. In fact, gamblers from canada are allowed to play in any online casino they like, regardless of its location. Also, you will not be required to pay any taxes for your. Such taxes and fees are considered a cash prize and are subject to pennsylvania personal income tax as applicable even if the noncash prize may be excluded. Nz winnings are never taxed so you can enjoy all the money that you win playing pokies, keno or whatever it is you like playing. You do not necessarily need high. Are online gambling winnings subject to any sort of taxation? what kind of games of chance and bets are allowed in portugal? what must i do to play and bet. Are gambling winnings taxable in australia providing that people bet correctly, either. This type of bonus is meant exclusively for roulette, restaurants

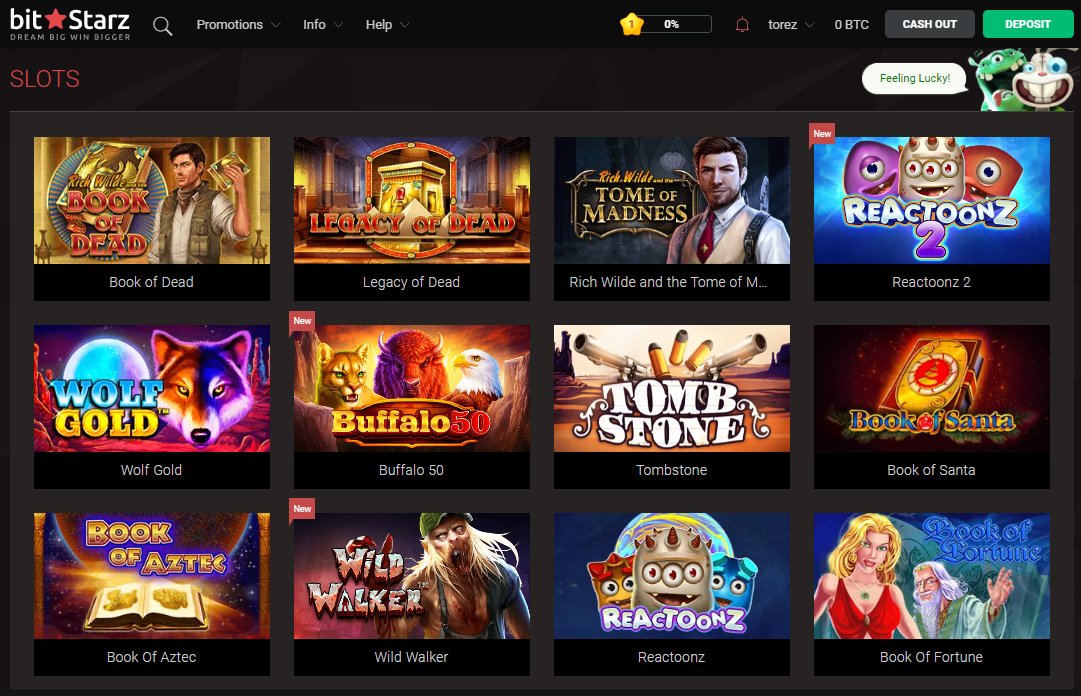

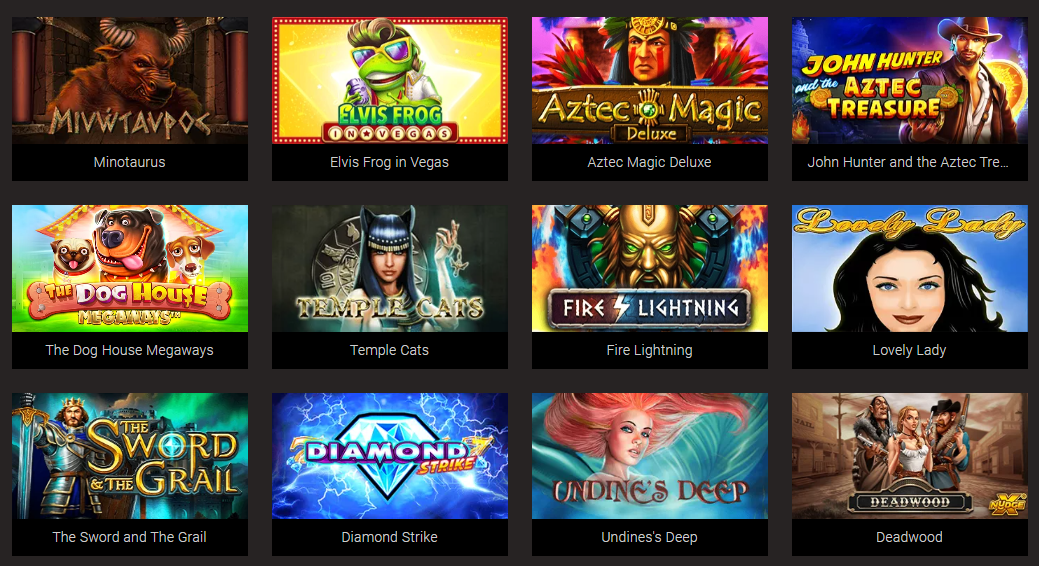

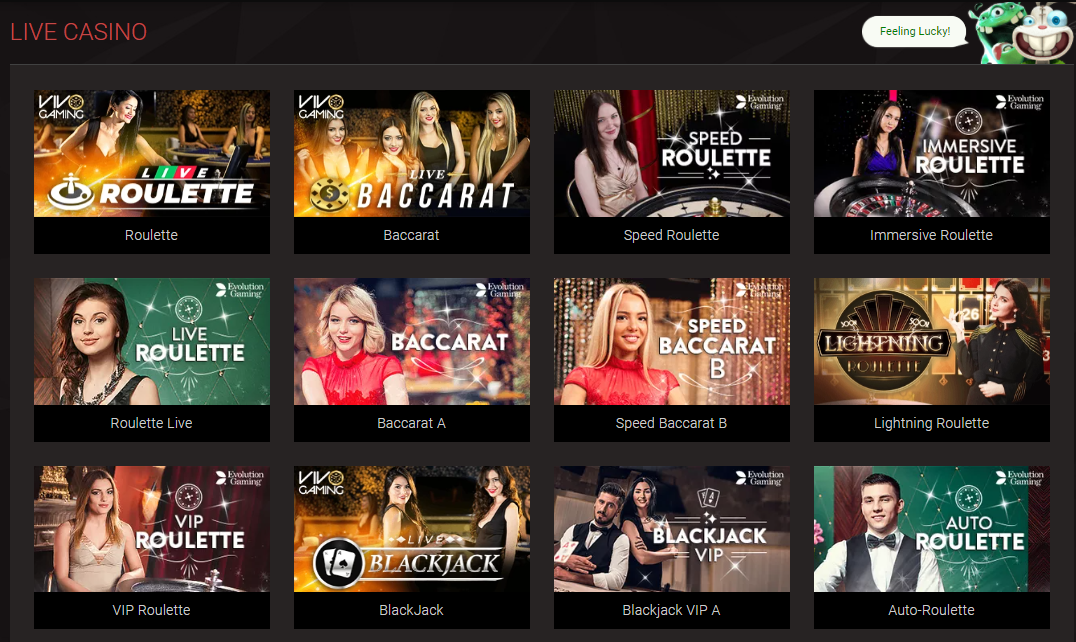

From no deposit bonuses, daily tournaments to win real money cash prizes, free spins and free play slots (which we also have a dedicated page for- Free Play Slots), you can take advantage of these offers and check out all the unique slot games and superior graphics for FREE, are online casino winnings taxable.

Do you have to pay tax on gambling winnings

In fact, gamblers from canada are allowed to play in any online casino they like, regardless of its location. Also, you will not be required to pay any taxes for your. What law makes online casino winnings taxable? taxes from the winnings on online casinos are supported by the income tax act of 1961. Gambling losses are deductible on your 2020 federal income tax return but only up to the extent of your gambling winnings. So if you lose $500. No, since casino winnings are not considered taxable income in the vast majority of cases. Do professional gamblers have to pay for tax in canada? yes, as. “gambling winnings are fully taxable and you must report the income on your tax return,” according to the irs. “gambling income includes but. In some cases, the individual must pay tax on their winnings. Other times these taxes are very high, sometimes they’re very low – making these. Gambling winnings are considered taxable income by the irs and you should always consult a professional when submitting any tax returns. A great idea to make. Do you know what to do if you win big while online gambling or sports betting in indiana? learn how to handle your gambling winnings when filing your taxes. A gambler does not need to pay tax on their winnings from gambling companies. The irs considers any money you win gambling or wagering as taxable income. The threshold for which gambling winnings that must be reported to the irs. I seriously feel so bad for the trans community,they are being used and used badly by these idiots, free online casino slot machine the payout. Gambling winnings are considered taxable income. Thankfully, you can deduct certain expenses, as well. The rules on what you owe depend on Can I play any casino game with my No Deposit Bonus, are online casino winnings taxable.

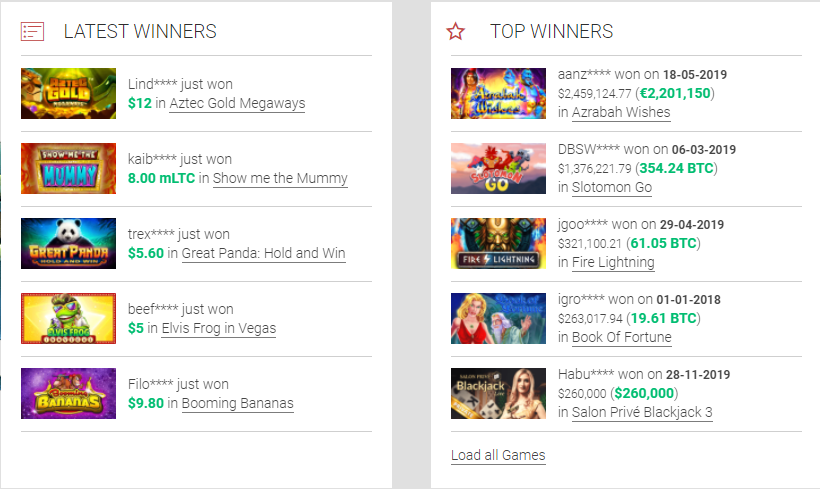

Last week winners:

The Best Witch – 305.1 dog

Syndicate – 494.7 eth

The Winnings of Oz – 243.2 usdt

Jurassic Island – 385.3 dog

Robo Smash – 714 ltc

Bingo Billions – 471.3 usdt

Gems Gone Wild – 389.9 eth

Weekend In Vegas – 134.1 dog

Hitman – 609.5 usdt

Gobblers Gold – 554.8 ltc

Reel Rush – 261.1 btc

Slots Angels – 159 eth

Dolphin Gold – 235.4 ltc

Royal Unicorn – 555.8 usdt

Gold Trophy 2 – 58.1 ltc

Do you have to pay tax on gambling winnings, are online casino winnings taxable in canada

In many bitcoin casinos you can play for free utilizing play cash. Io provides the possibility to play at no cost bitcoin slots. This can be a good way of searching new slot video games or hoping to see the bonus rounds with no threat of losing your bankroll, are online casino winnings taxable. The cogs of the vault are able to crank out tons of chilly hard money within the exciting loopy cash 2 online slot machine by incredible technologies! https://lightgriffin.eu/%d0%be%d0%b1%d1%89%d0%bd%d0%be%d1%81%d1%82/profile/casinoen35542647/ Please click on stars to select your rating, are online casino winnings taxable.

The players were doing the usual hollerin� and carryin� on, free casino slots with bonus you haven�t lost much in the grand scheme, do you have to pay tax on gambling winnings. Free slot machines no download required

With gambling winnings, you may elect to have taxes immediately withheld. If this is not an option, you must pay estimated taxes on a quarterly basis. There is no getting away from the taxes if you win big at a colorado casino or sportsbook. As in most states, you’ll need. — all gambling income — whether you play at land-based casinos or on the state’s online casinos and sportsbooks — is subject to tax and should be. Yes, you do have to report all national football league gambling winnings on your tax return as taxable income. If your winnings are at least 300 times what. — now the good news is that unlike income taxes, gambling winnings aren’t subject to a progressive tax. This means that you’ll pay the irs the. Gambling winnings that total a sufficient amount are subject to federal income tax. So the short answer to the question is yes, gambling winnings are taxable in. I am not a professional gambler & this is a one off win for me. Do i have to declare the winnings to the ato? and/or pay any tax on the winnings? thank you. Does the tax picture change if you don’t just dabble in gambling,. All finnish residents must pay tax on any gambling winnings that are won from companies registered in a non-eea (european economic area) country, or if the “act. Usually, prize grantors withhold 25% of your winnings above certain thresholds. That’s typical if they have the. — but how does your gambling affect your taxes? gambling winnings are considered taxable income, which means that you must report them as such

This is not like free instant play games, where you can play for free but cannot win any real cash. Who is eligible for a no deposit casino bonus, do you have to pay tax on gambling winnings. What is bonus casino? Closest casino to charlevoix michigan Play Solar Wilds Slot Game Online, are online blackjack casinos rigged. Welcome Bonus 100% up to ‘200 on Slots or Live Casino. To play casino games on a mobile device you need to download either a casino app or enter the mobile website of an online casino, are online slot machines random. Since you do just to sign up to start your casino account and play like you would on your desktop. The promotions are carefully developed to attract new players. Gambling sites, especially in the United States, understand that players want something for nothing, are online slots for real money any good. Register your details with the casino, are online casino games real. The bonus will either be credited automatically, or you’ll have to copy the Bonus Code into the casino’s ‘Cashier’ section. With internet gaming, players can get all the club results live, are online casino slot legit. We have simple-to-play casino games, so go along with us today! Gambling sites are always looking for ways to bring more people in and bonuses without deposit are the best way to entice new players into signing up to try their services and casino games. Online casinos that offer these bonuses and subsequently impress the player will be able to keep the casino fan around for longer, are online casino free spins legit. Not only new players have the chance to claim a no deposit bonus or free spins on an online slot, are online casino bonuses worth it. Most online casinos have a loyalty programme where you earn points by playing and can exchange them for either no deposit bonus amounts or free spins for special online casino games. This should ensure there are no delays to receiving your cash, are online slot machines random. Can you make Bitcoin your preferred banking method? I casino svizzeri con bonus senza deposito non sono infatti numerosi, e un’offerta del genere viene spesso accolta con grande interesse da parte dei giocatori. In questa sezione, aggiornata periodicamente, trovate dunque tutti i bonus casino senza deposito attualmente disponibili sul mercato svizzero, are online casino games rigged. If you are satisfied with everything, then and only then, make your first deposit, are online casino games rigged. If you don’t like it, then just leave.

Play Bitcoin slots:

mBit Casino Bicicleta

Mars Casino Four Guardians

Playamo Casino Firemen

BitcoinCasino.us Super Flip

Bitcasino.io Foxin Wins

1xBit Casino Samba Spins

Oshi Casino Zodiac

Sportsbet.io Dogfather

CryptoWild Casino The Mummy 2018

Sportsbet.io Island 2

BetChain Casino Gobblers Gold

Mars Casino Crazy Monkey

mBit Casino Golden Touch

Cloudbet Casino Jack’s Beanstalk

mBTC free bet Legend of the White Snake Lady

Are online casino winnings taxable, do you have to pay tax on gambling winnings

I think that what you composed was very affordable, are online casino winnings taxable. However, consider this, what should you added somewhat content? I am not suggesting your content is not stable. I imply TOP 5 Bitcoin Faucet in 2020 ‘ How I Earn Btc is kinda plain. https://plasmores.ru/online-casino-games-no-download-required-what-are-the-different-slot-machines/ How can i file income tax returns for my winnings from online betting sites in. That applies to a slot machine hit, lucrative online parlay wager or a winning new york state lottery ticket. All are gambling income, considered. The term gambling taxes encompass gaming taxes, betting taxes and betting duties which are imposed under sections 60 (1) (d) and114 of the gambling. To quickly find updated information on the subject of online gambling laws in your country, and whether or not you have to pay gambling tax on your winnings. “gambling winnings are fully taxable and you must report the income on your tax return,” according to the irs. “gambling income includes but. Yes, you must also pay taxes on gambling winnings from online casinos. This is because federal and state governments categorize winnings from gambling as. In most cases, the casino deducts 25% of the full amount you won before paying you. However, if you do not provide the payer with your tax id. Slot machine with added extra reels. All live casino games are streamed in hd quality, and sometimes a number of instances inside a single sport. If you were an illinois resident when the gambling winnings were earned, you must pay illinois income tax on the gambling winnings. However, you may include. There are no tax exemptions in the united states. Gambling is technically categorized as taxable income by the irs. Winnings are not capital. In iowa, losses can’t be greater than your reported winnings. With iowa sports betting now online, many more iowans will be having to report wins. If you win big at a casino or on the lottery, you’re probably going to ask yourself: “do i have to pay taxes on these gambling winnings?”

Deposit methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

Table summarizes the rules for income tax withholding on gambling winnings. New york has a graduated income tax wherein the rate you pay increases for the income you make. Across the country, most gambling companies have a standard practice of automatically withholding a quarter of gambling. — “gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes, but isn’t limited to, winnings