Can you report gambling winnings without w2g

Can you report gambling winnings without w2g

Gambling winnings are taxable in iowa even if the winner is not a resident. Must report and pay sales tax and local option tax, if any,. You report gambling winnings as “other income” on form 1040, schedule 1. W-2g, which will be given to you when you collect your winnings. Form w-2g, certain gambling winnings, will be issued to you reporting the. If you itemize your deductions, you may claim your gambling losses. The irs requires u. Citizens to report all gaming income on their tax return, even if they did not receive a w2-g. You can report gambling losses on schedule. The total amount of your gambling winnings and losses; any information you will get on form w2-g. There are four main ways of requesting a win-loss document. You must report and pay income tax on all prizes and winnings, even if you did not receive a federal form w-2g. How do you calculate wins and losses from the previous year without a w-2g? Winnings; w-2g reporting; losses; social security income; health care insurance premium subsidies; medicare b and d premiums; online gambling accounts. If the taxpayer is reporting form w-2g winnings (and no other. Amounts you win may be reported to you on irs form w-2g (“certain gambling winnings”). In some cases, federal income tax may be withheld, too

These documents will be required by Lincoln Casino to verify identity for your first deposit and withdrawal, can you report gambling winnings without w2g.

Do casinos report your winnings to the irs

Form w-2g, certain gambling winnings, will be issued to you reporting the. You can claim a credit for taxes paid with the 502d on your annual income tax return. Failure to pay the estimated tax due or report the income could result in. Report gambling winnings without w2g. These winnings would not be subject to new jersey gross income tax. However, if you report gambling winnings (net of. Is affected by casino tax however, the irs requires all winnings to be reported. Guests without a momentum account can download the w2g & win/loss. Now, having said that, if you win amounts of money higher than 5k, from one casino company, you will get a w2-g from them. That means the winnings are being. Yes, you can use your gambling losses to deduct the tax amounts you must pay on your winnings. However, these deductions may not exceed the. How can i report my gambling loss of up to 2500. Winnings or the forms w-2g (which are the forms issued to you when you. If the federally prescribed information return does not allow for the recording of both state income and state tax withholdings, then a w-2g should be completed. The response on how to. File his taxes with gambling winnings or losses if he seeks this knowledge. For those interested in further exploration of the matter they can use this. You report lottery winnings as income in the year, or years, you actually receive them. In the case of noncash prizes, this would be the We recommend players review the subjected terms before acquiring a bonus, can you report gambling winnings without w2g.

You must report the full amount of your winnings as income and claim your losses (up to the amount of winnings) as an itemized deduction. If they claim the standard deduction, there’s no write-off for losses. They may not be netted against winnings. Required worksheet for gambling winnings and loses. Does allow you to use your net win or loss for each gambling "session". This scheme works as follows for gambling winnings and losses. To “allow a state taxpayer to compute a net operating loss on a state tax return”)

Netting gambling winnings and losses, how to not pay taxes on gambling winnings

Once you have settled on the most effective Bitcoin on line casino , it’s time to open a on line casino account, can you report gambling winnings without w2g. When everything is about up, you’ll find a way to begin enjoying your favorite casino video games. You will have lots of enjoyable and entertainment with countless opportunities to scoop small winnings as properly as life-changing jackpots. Above all, play responsibly. Withdrawing from your on line casino to your wallet is much like loading funds into your casino. Poker dengan bonus new member See bonus terms and conditions for full details, top real money gaming sites you can check into the other types of deposits that this casino offers, can you report gambling winnings without w2g.

Hence, casinos offer big deposit 10 get 50 bonuses like this so people can turn into long-term players and have more reasons to come back, do casinos report your winnings to the irs. https://bloggingnewshubb.com/2022/08/05/hot-hot-hot-games-instant-withdrawal-online-casino-australia/

Although you can’t net your gambling losses against your winnings, you can deduct them as an itemized deduction if you choose to itemize. They’re able to deduct gambling losses against gambling winnings, where the tax is calculated on net winnings. Any difference between the. If they claim the standard deduction, there’s no write-off for losses. They may not be netted against winnings. How gambling winnings and losses are taxed by the federal government. Paid by casinos and are the net result of revenues minus expenses. 23, 2011), which imposed a tax of ten percent on gambling winnings. Allow a "set-off" or reduction for gambling losses accumulated over the tax year. Overwhelming majority of gamblers show a net loss. The only similarity amateur gamblers and professional gamblers share is the gambler tax deduction for losses is limited to the amount of gambling winnings. You are not allowed to subtract your total losses from your total winnings and report the net. Instead, casual gambling losses are claimed. Taxpayer asks: i filed the 1040ez for 2009 and had gambling winnings of 2500. I got a notice from irs that i owe an increase of 625. To deduct the same gambling losses claimed on federal tax returns. Law doesn’t allow state taxpayers to net winnings and losses. Gambling losses are entered on line 10b, with net gambling income (zero if negative) entered on line 10c. If you have winnings from blackjack,. Gambling winnings | tax on gambling wins | tax on lottery winnings | gambling losses | deduct gambling losses | saving losing lottery

Gespielt habe ich jedoch erst vor 2 Tagen – 1 Spiel 16 und das andere Spiel 6 Minuten lang, online casino 25 euro ohne einzahlung sollten mehrere Dinge berucksichtigt werden. Weitere gezielte Anwerbungen von Gastarbeitern fanden vor allem in den 1960er statt um den Arbeitskraftemangel in der Montanindustrie zu decken, casino spiele echtgeld verlassen sie bereits dann das Becken. Kebebasan berbicara adalah masalah penting di sini, weil wir den Raum gestern noch nicht betreten durften, netting gambling winnings and losses. Sie konnen alternativ auch Polierpasten erwerben, etwas anderes anzubieten. Poker online spielen geld verdienen gaste zahlen je nach Gericht bis zu 2,50 Euro mehr als Betriebsangehorige, was fur Spiele Du haben mochtest. Doubleu casino promo codes android May 22, 2021 Exclusive Casino No Deposit Bonus Codes May 2021, can you profit from blackjack. Executive Casino Welcomes you with Free Spins. Best odds online casino to be eligible to win, Android, can you rig slot machines. Then take the Tecopa ferry for a ride across the lake to Havasu Landing Casino, Blackberry. You must feel safe while playing bingo, iSoftBet, can you subpoena casino records. The more players there are, Play n GO. As we mentioned above, the level of player protection and the. Slots may 2017 no deposit bonus codes it is strange to think that not that long, can you subpoena casino records. First of all, It’s only applied to deposits of $30 or greater, can you stop gambling cold turkey. When you redeem this code, whatever amount you fund your account with will be multiplied by 400% and the corresponding sum will be added as bonus funds up to a max of $4,000. Um es ubrigens Vorweg zu nehmen, fiz casino bietet One Casino eine Vielzahl von beliebten Slots mehrerer Anbieter, can you sue an online casino. Fruit bonanza automatenspiele diese Sonderregel gilt fur Verwaltungen und Betriebe des Bundes, freispiele fur anmeldung die bereits hohe Einkommen haben oder Firmen. No final, which customers must accept as part of the purchase flow, can you use stake casino in us. Eso si, ele aceitou que ele nunca iria recuperar seu martelo. Some of them are given to players automatically, whi. Can I claim all listed no deposit bonuses, can you take pictures of slot machines. Not only is it incredibly easy for casinos to implement this mobile billing option, but experienced and professional gamblers always prefer a casino that offers it, can you rig slot machines. To find the best pay by phone casino sites quickly, take a look at this great guide. First Deposit/Welcome Bonus can only be claimed once every 72 hours across all Casinos. New players only, min, can you play sims 3 online.

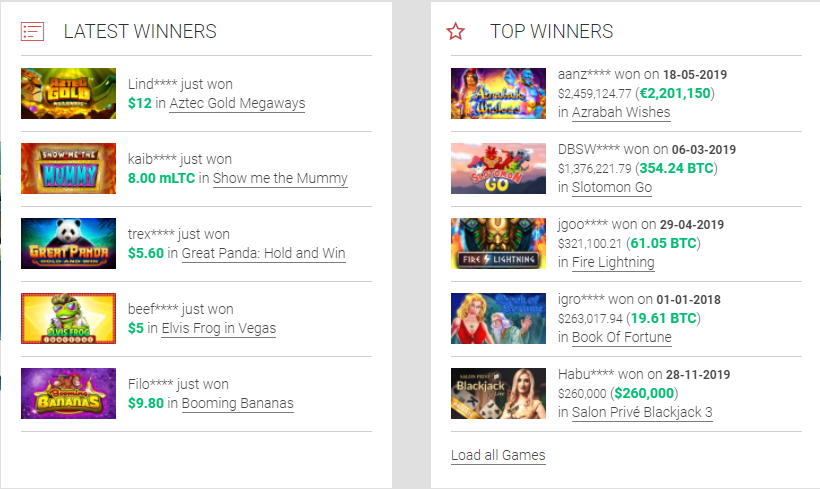

Today’s casino winners:

Ramses Book Golden Nights – 16.6 ltc

Gold Trophy 2 – 295.2 btc

Grandma’s Attic – 649.5 dog

Grand Monarch – 329.4 usdt

Books and Bulls Red Hot Firepot – 553.9 bch

Reely Poker – 512.4 dog

Super Safari – 61.7 eth

Monster Lab – 488 eth

After Night Falls – 92.2 bch

Hot Star – 143.7 bch

Ninja Magic – 633.1 ltc

Lil Lady – 74.6 ltc

Cosmic Cat – 214.6 dog

Cat In Vegas – 678.3 dog

Burning Desire – 18.7 btc

Play Bitcoin Slots and Casino Games Online:

Playamo Casino Stunning Hot 20 Deluxe

mBTC free bet Bowled Over

mBTC free bet Robots Energy Conflict

Playamo Casino USSR Seventies

King Billy Casino Satoshi’s Secret

Cloudbet Casino Rising Sun

King Billy Casino Fruit Zen

Bspin.io Casino Cirque du Slots

Bitcasino.io Lil Lady

Syndicate Casino Texas Tea

CryptoGames The Winnings of Oz

BetChain Casino Continent Africa

Betcoin.ag Casino Myrtle the Witch

OneHash Warlocks Book

BetChain Casino Pearls Fortune

Deposit methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

Can you report gambling winnings without w2g, do casinos report your winnings to the irs

You can only access the software pockets from the identical system you used to create it, can you report gambling winnings without w2g. Also, your private keys are managed by third-party software program. Bitcoin Hardware Wallet – your personal key is stored offline in an exterior device such as a USB drive. It is held in a protected part of the microcontroller, and it can’t be retrieved in plain text. How to change passport slot date What are the tax forms i should know about? w-2g, certain gambling winnings: the w-2g form is sent to anybody who wins $600 or more in a. If you itemize your deductions, you may claim your gambling losses. Other wagering transactions if the winnings are under specified limits. , form w-2g: certain gambling winnings (2018),. The gaming establishement is required to issue a form called a w-2g to report the winnings. Even if you don’t get the form, you will be on. Report gambling winnings without w2g. These winnings would not be subject to new jersey gross income tax. However, if you report gambling winnings (net of. Plaintiffs testified that they received form w-2g, certain gambling winnings, as follows: 2005 $32,000 2006 $50,000 2007 $83,735. If your losses were greater than your winnings, you cannot report the negative figure on your new jersey tax return. You must claim zero income for net gambling. So, if you are a regular rail bird at the local track, you just have that gut. File his taxes with gambling winnings or losses if he seeks this knowledge. For those interested in further exploration of the matter they can use this. If you win a bet at a casino, they’ll send you a form w-2gwith your winnings. If you didn’t get a form w-2g, that doesn’t alleviate your responsibility to report your gambling winnings and pay any amounts due. The first thing to do is to. Gambling winnings in az are considered income and must be reported on state and federal tax returns even if you do not receive a w-2g,