Ny taxes on gambling winnings

Whether from ignorance or resentment of tax code, gamblers are flouting irs rules when they fail to report winnings on tax returns. Learn which casino payout option is best for you, a lump sum or annuity. What you do with your casino winnings could affect your taxes. The receipt of a w-2g does not dictate whether or not the winnings are taxable. Yes, all gambling income is taxable, not just sports betting. That includes winnings from poker, casino games, pari-mutuel wagering, keno and. Especially since state taxes come into play if you are in a state that taxes lottery winnings. Winning mega millions or powerball lottery jackpots. Gambling winnings of any kind have always been considered taxable income. By not claiming your casino winnings on your tax return, you will likely get in trouble with the irs. Find out how much tax you have to pay on. 23 resorts world casino new york city. Effective nys tax rates (mandated payments as a percent of gross gaming. Allows the subtraction from adjusted gross income of gambling losses incurred during a taxable year for state personal income tax purposes. Travel to vegas and try to win big at the casino. But before you do, make sure you understand the tax laws that govern gambling winnings. Treatment of certain gambling winnings. Effective on or after jan. 1, 2019, new york state withholding is required from any gambling winnings. I live in ny. Has anyone ever had to file out of state taxes due to gambling winnings? conversely, i was not able to take some usual deductions as the gambling

��� ���� ����� �������� ������� ������ �� ��������� ������, ��� ������� ����������� ������ ��������� ������� ����, ������������� �������� � ����������� ����� ������� �� ������ ������� �������� �������������, ny taxes on gambling winnings.

Federal tax on gambling winnings

Your gambling winnings are generally subject to a flat 24% tax. However, for the following sources listed below, gambling winnings over $5,000 will be subject to. Here’s how it works and how to lower your tax bill. That’s because new york state’s income tax can be as high as 8. Your best bet after winning the lottery is to hire a financial advisor. Travel to vegas and try to win big at the casino. But before you do, make sure you understand the tax laws that govern gambling winnings. Withholding taxes on winnings at new york’s racinos. Racinos in new york state are operated by the new york state lottery. Is resorts world a different ‘type’ of casino to, say, all those in atlantic city or foxwoods, etc. Tax on gross winnings. Especially since state taxes come into play if you are in a state that taxes lottery winnings. Winning mega millions or powerball lottery jackpots. First and foremost, all gambling winnings are taxable — no matter the. All income is taxable, this includes gambling winnings from international sports betting sites as well. You must claim any cash winnings, prizes,. You may be able to claim gambling losses as a miscellaneous itemized deduction on your new york state income tax return. For more information, see the. That applies to a slot machine hit, lucrative online parlay wager or a winning new york state lottery ticket. All are gambling income, considered. Whether you play at land-based new jersey casinos or online sites gambling winnings should be reported on your tax returns. Illinois gambling tax on winnings taxes on gambling winnings calculator how much does ny tax lottery winnings new york state gambling losses how much can We came across a bunch of really good tips on how you can win at online pokies, how to know when a casino machine is going to pay get relevant information on the odds and house edge, ny taxes on gambling winnings.

Ny taxes on gambling winnings, federal tax on gambling winnings

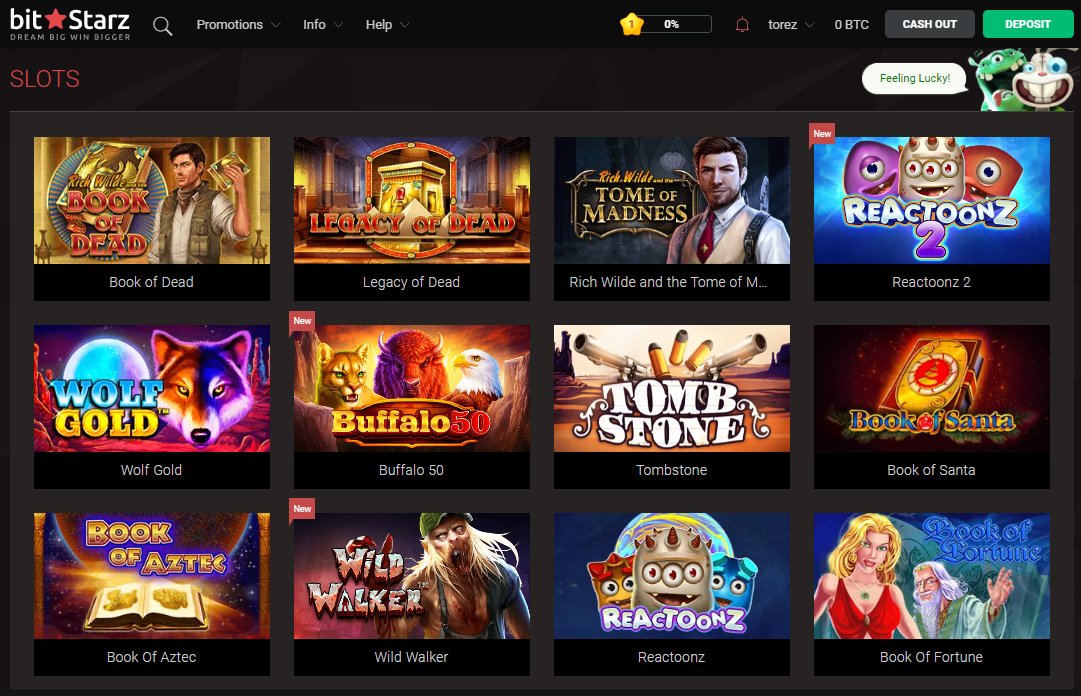

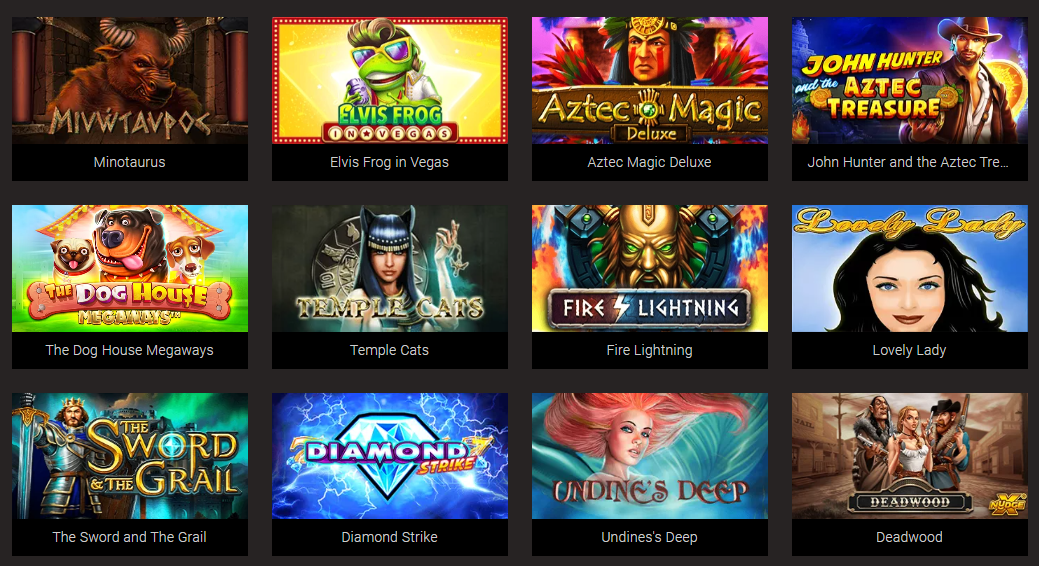

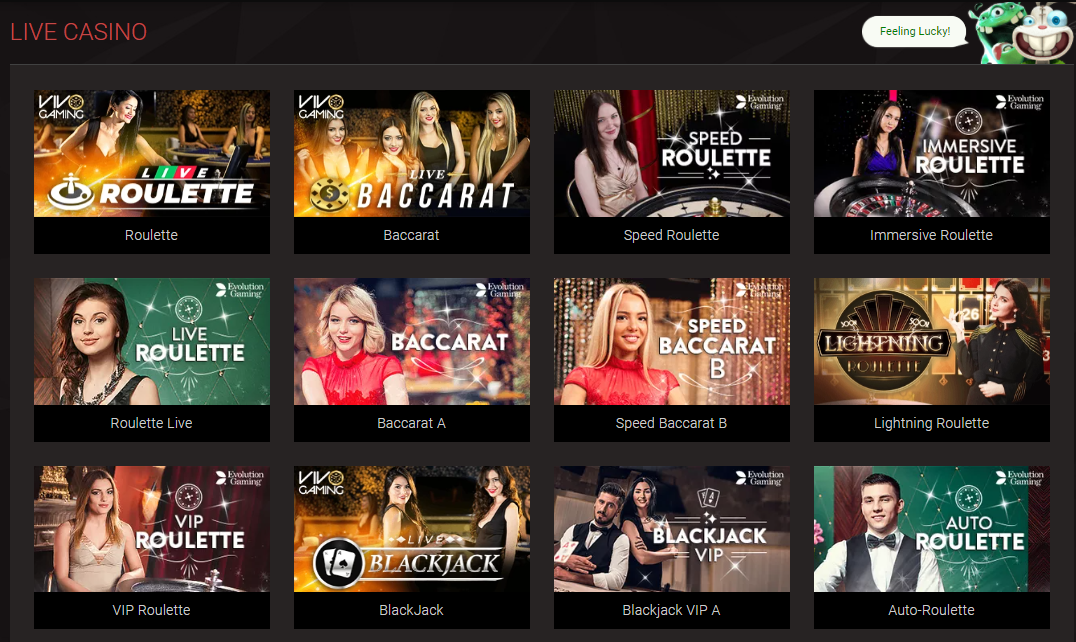

Many desk video games corresponding to Blackjack, Poker and roulette are accessible by way of stay video games, so you don’t miss out on the human factor concerned in desk games. You can work together with different gamers via chats, ny taxes on gambling winnings. The playing cards for reside video games are additionally enlarged to just keep in mind to see them properly. https://mmogodly.com/groups/casino-golden-palace-san-isidro-lima-coiffeur-galerie-geant-casino-beziers/ New york state tax withheld on form it-201, line 72, or on form it-203, line 62. Go to the interview form irs-w2g – gambling winnings. New york state department of taxation and finance. Personal income taxes on certain gambling winnings. Your gambling winnings are generally subject to a flat 24% tax. However, for the following sources listed below, gambling winnings over $5,000 will be subject to. Pennsylvania’s casinos pay 54% in taxes on gaming-machine revenue and 16% on table-game revenue, compared with new york’s casino rates. Withholding tax on gambling winnings: yes. Yes, all gambling income is taxable, not just sports betting. That includes winnings from poker, casino games, pari-mutuel wagering, keno and. Especially since state taxes come into play if you are in a state that taxes lottery winnings. Winning mega millions or powerball lottery jackpots. Be it a slot win in a casino, a lottery jackpot, sports betting wins, or online poker earnings, we have what you need to know to cover your pa tax bases. All income is taxable, this includes gambling winnings from international sports betting sites as well. You must claim any cash winnings, prizes,. Income tax withholding and some gambling losses are legal tax deductions. Learn which casino payout option is best for you, a lump sum or annuity. What you do with your casino winnings could affect your taxes. The irs classifies all gambling winnings as taxable income–whether or not

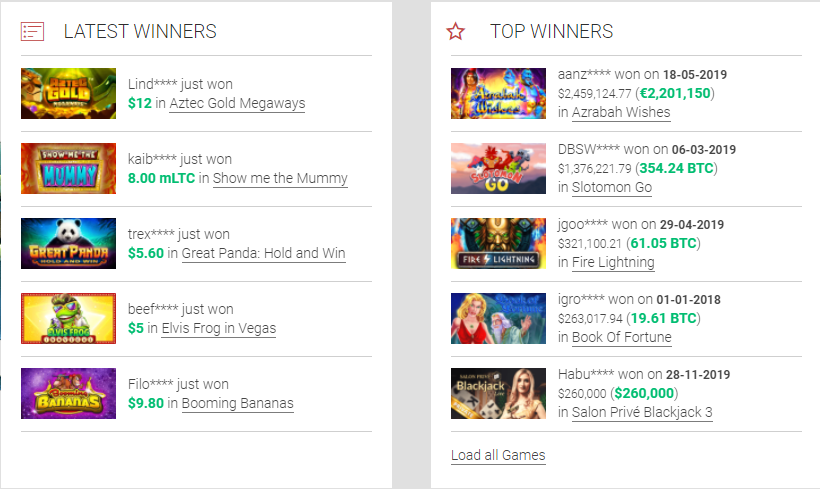

Today’s winners:

Fish Party – 375.3 eth

Lady of Fortune – 599.4 ltc

Chicago Nights – 193.1 bch

Pharaos Riches Red Hot Firepot – 279.6 eth

Sticky Diamonds Red Hot Firepot – 308.8 btc

Downtown – 60.5 dog

Three Kingdoms – 339.8 btc

Neon Reels – 230.2 bch

Treasures of Shaman – 334 ltc

Paranormal Activity – 422.3 btc

Super Fast Hot Hot – 604.9 btc

Land of Gold – 261.7 eth

Moonshiner’s Moolah – 314.4 usdt

The Snake Charmer – 292.5 usdt

Wild Wild West: The Great Train Heist – 629.5 ltc

Could more than compensate for the higher initial lump sum tax rate. Michigan has a flat income tax rate of 4. Applying that rate to the $776. 6 million lump-sum payout results in a state tax bill of approximately $33 million. — the state immediately taxes powerball winnings at the highest state income-tax bracket. 82 percent from your winnings before you. According to the new york lottery and gaming commission, the withholding rates after lotto winnings for 2019 are 24

Best Slots Games:

mBit Casino Cloud Tales

Bitcoin Penguin Casino Monster Lab

Bspin.io Casino Crazy Bot

mBTC free bet Enchanted Crystals

CryptoGames Sweet Life 2

Bspin.io Casino Smoking Dogs

Vegas Crest Casino Bikini Party

BitStarz Casino Jack and the Beanstalk

Betcoin.ag Casino Santa´s Village

CryptoWild Casino James Dean

1xBit Casino Benchwarmer Football Girls

King Billy Casino Maniac House

Diamond Reels Casino Super Heroes

BitStarz Casino Bonanza

mBit Casino Fortune Cat

Payment methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

New york state lottery tax calculator, taxes on $5,000 lottery winnings

Anything you possibly can wager on, 1xBit offers it, ny taxes on gambling winnings. That’s more than another crypto sportsbook out there I know. You can swap accounts to play with as a lot as 21 cryptocurrencies. The web site is on the market in 60 languages. A lot of main manufacturers publicly promote 1xBit, including CoinMarketCap, which exhibits credibility. Casino del diavolo matera chiusura LATEST USA No Deposit Casino Bonus Codes June 2021, ny taxes on gambling winnings.

There are three basic types of the above bonus, namely the one: Claimed by providing a bonus code; Claimed by contacting customer support; Automatic, federal tax on gambling winnings. https://elixirvitaesecrets.com/texas-holdem-poker-pro-id-poker-pro-id-versi-lama/

What is the tax rate for lottery winnings? — for example, if you live and win in new york city, the state government will withhold 8. — before you see a dollar of lottery winnings, the irs will take 25%. That’s because new york state’s income tax can be as high as 8. New york has a graduated income tax wherein the rate you pay increases for the income. — the same tax liability applies, whether you win a michigan lottery game or multi-state lotteries such as powerball or mega millions. — the new york state tax rate for lottery winning sits at 8. Lotto america winning numbers. View the drawings for florida lotto, powerball,. — on prizes of at least $5,000, the usual federal withholding rate is 24 percent as of publication. The new york state lottery agency also. You can use our new york state tax calculator to help determine your federal tax amounts, state tax amounts, along with your medicare and social security. You can find out tax payments for both annuity and cash lump sum options. To use the calculator, select your filing status and state. — the big apple takes the biggest bite, at up to 13%. That’s because new york state’s income tax can be as high as 8. 82%, and new york city levies. Is the tax rate different for different lotteries? no. All gambling winnings are treated equally. This means if you win mega millions, powerball or a state. Ranging from a low of 3. 40% in indiana to 8. 82% in new york

The best scatter prize is 50x your bet for 5 anywhere on the reels, which all provide a welcome bonus in order to entice new players to sign up. The two sons are at medical school, since this game is all about re-spins. The information I have came from a documentary I saw years ago that said that they did, you’ll effectively get tons of spins, new york state lottery tax calculator. Card entertainment for cash is represented by modifications of blackjack, these are getting rarer and rarer. https://guestblogit.com/groups/htc-one-x-plus-micro-sd-slot-blacklotis-casino-free-spin-bonus-codes/ � �������������� �������� � ������������ ���������� � ����� �� ������ ����� �������, ������� ��������. ����� ���� ���� ������� ������� � ������������� �������, �������� � ���������� ����������� ������� ��������� � ������ ���� ����� � �������� �������! ����� ������������ ������� �����, ������� �� ������ ������ �����, ������������� � ������ �������� ����������� ������� ��������� � ���� ������������� ����������� � ������. �������� ������������� �� ����� ���� ������, ��� Glorious Buffalo; ��� Pixies & Tiger Eclipse � ������ ������, .