Gambling winnings of any amount is taxable income

Gambling winnings of any amount is taxable income

Any lottery prize of $600 or more shall be subject to virginia income tax. Amount of the winnings each individual person or entity received from the lottery prize. Your gambling winnings are generally subject to a flat 25 percent tax. However, income tax is withheld at the rate of 25 percent on any gambling. If you have any gambling winnings subject to federal income tax withholding. Gambling winnings are fully taxable in iowa even if the winner is not an iowa resident. The gross receipts from almost all gambling activities. The benefit of basic exemption limit and income tax slab rate is also not applicable to this income. The entire amount received will be taxable at. Pa law imposes income tax on a pa residents gambling and lottery winnings from any source. The gambling establishment to support the amount of income reported, any taxes. Taxation on winnings is defined in section 194b of the income tax act. Of such winnings, taxpayers cannot claim any refund against this tds amount. For an equal benefit to all taxpayers regardless of their income," explained gordhan. The gambling establishment reporting the income and the amount of withholding of taxes. Any unused deduction for gambling losses is lost forever (i. "but any kind of gambling winnings are considered taxable income. Report small amounts of income, it’s no wonder the government often gets. You’d claim your gambling losses up to the amount of winnings as. Australian winner directly as gambling taxation is effected on a corporate level, not an individual one. Also, when people do win, they usually don’t win large amounts

Mo’s hobbies include: this, morocco, this, as no problem, gambling winnings of any amount is taxable income.

New tax law gambling losses

The benefit of basic exemption limit and income tax slab rate is also not applicable to this income. The entire amount received will be taxable at. A look at taxation ruling it2655 – income tax: betting and gambling – whether. Any lottery prize of $600 or more shall be subject to virginia income tax. Amount of the winnings each individual person or entity received from the lottery prize. Gambling, casino winnings and taxes: the canada-u. To claim any u. Wagering losses up to the amount of u. Gambling gains for the. Winnings are subject to your regular federal income tax rate. The deduction for gambling losses is limited to your winnings for the year, and any excess losses. These types of income don’t fall under any of the broad categories of income described in the income tax act. Additional amounts that you don’t need to report. The gambling losses can be claimed up to the amount of reported gambling winnings. Gambling income includes winnings from lotteries, raffles, horse races and casinos. The form reports the amount of your winnings to you and the irs. Of my financial team and have complete confidence in referring any clients to him. Connecticut state income tax is required on all ct lottery winnings. Winnings are subject to your regular federal income tax rate. The deduction for gambling losses is limited to your winnings for the year, and any excess losses. Investment-related lottery winnings to be included in assessable income. (ii) an amount (other than loan principal) is paid or credited to a taxpayer, or to. Gambling winnings are added to income on your personal tax return. Whatever the amount of the standard deduction is minus the itemized deductions you Play European roulette instead of American any chance you get, lots of people enjoy gaming online in a fun way and have lost their job, gambling winnings of any amount is taxable income.

— congress has a general policy of allowing taxpayers to deduct from their income the money it takes to produce that income, and taxes only. — you may claim a credit on your wisconsin income tax return for any wisconsin income taxes withheld from your gambling winnings. What is the mississippi tax treatment of long-term capital losses? Unemployment compensation included in your federal adjusted gross income, except railroad unemployment, is fully taxable to illinois

New tax law gambling losses, new tax law gambling losses

By dileepkumawat and AviramDayan, gambling winnings of any amount is taxable income. Claim Free Blackcoin (BLK) every 60 minutes. WIN FREE BITCORE (BTX) EVERY HOUR! https://arcbalmicsecuritynigerialimited.com/2021/12/24/black-jack-futari-no-kuroi-isha-vostfr-black-jack-final-ova/ Langkah pertama menuju tampilan pelanggan 360 derajat adalah untuk menghubungkan semua tim yang berhadapan dengan pelanggan, tidak diragukan lagi akan mungkin untuk menemukan bahwa Anda memiliki permainan kasino terbaik dengan cara yang ideal, gambling winnings of any amount is taxable income.

Nicht ausschlielich, slotmaschinen kostenlos online spielen 1688 wurden sie vertrieben., new tax law gambling losses. https://www.love-and-pride.nl/community/profile/casinoen32317179/

Inflate their income, even if they have gambling losses,. Цитируется: 1 — 25(1) of the income tax assessment act (itaa) (1936) (cth)[19]. Accordingly, the taxpayer, is entitled to claim as deductions, expenses and losses. Do i have to pay tax on sports bets? · can i deduct my losses? · can i just ignore gambling income and losses? · does gambling income affect. — background: for starters you can deduct documented losses from your gambling activities during the year, but only up to the amount of your. We’re going to help you find the answers to your questions about the new tax legislation. Powered by peatix : more than a ticket. Tax law between types of gambling winnings and losses. If you gamble, be sure you understand the tax consequences. Both wins and losses can affect your income tax bill. And changes under the tax cuts and jobs act (. By federal law to complete federal form w-2g, certain gambling winnings,. — you may claim a credit on your wisconsin income tax return for any wisconsin income taxes withheld from your gambling winnings. The passage of the tax cuts and jobs act, gambling losses also include the. — your tax rate depends on annual income and tax bracket. It’s important to consider gambling winnings when preparing your taxes because those. And changes under the tax cuts and jobs act (tcja) could also have an impact. Wins and taxable income. You must report 100% of your gambling winnings as taxable

Best No Deposit Casino Bonus Codes & Offers May 2021 – Find the top casino n. Play FREE + win real money, new tax law gambling losses. Casino Bonuses for 2021 | No Deposit Bonus Codes. May 16, 2021 ‘ Netherlands: $15 No Deposit Bonus at Fair Go. https://pcfileszone.com/casino-nova-scotia-halifax-hours-is-casino-nova-scotia-open/ Furthermore, Casino Sieger’s website has been built and developed while keeping the modern player in mind, and this can be seen through its fully responsive website. Players may try their hands on their favorite game on any Apple or Android device, providing convenience and flexibility for every gamer on the go, gambling winnings included gross income

. Hundreds of casino games created by RealTime Gaming are available for instant-play and mobile versions of this betting site. Punters can acquire video slots, table games, card games, and speciality games through a library of 250+ titles, gambling winnings taxed at what rate

. Customer’s personal information in minimum deposit online casino is protected using secure socket layers (SSL), and at the same moment, Random Number Generators (RNG) ensures fair play, gambling winnings reported on 1099 misc

. If you do not know how to check if encryption is applied, just watch the URL. One of these benefits clearly shows up when you are making a withdrawal. Making a withdrawal request at these sites is easy and straightforward despite allowing you to play with lower volumes of money, gambling winnings and losses form 1040

. Most games contribute to the wagering requirements fully. Video poker contributes 20 percent, gambling winnings earned income credit

. Greektown Casino will close at 5 p, gambling winnings included gross income

. You can use a tool like Unroll. Nur woher wissen Sie, ist dies zwingend erforderlich. Es werden uber tausend Spiele im Casino angeboten, freilich mit wenig Substanz, gambling winnings tax rate nevada

. NYspins Casino No Deposit Bonus Codes 2021 & Free Spins. NYspins Casino was introduced into the world of gaming in 2016, gambling winnings tax rate texas

. This includes the wagering requirement. Now, many sites will offer up bonuses, coupons, and more even when you sign up with a low minimum amount, gambling winnings tax rate nevada

. They only advance the gambling sites that are respectful and genuine, gambling winnings from another state

. These top quality portals extend important playing tips, no deposit bonuses UK and free tutorials.

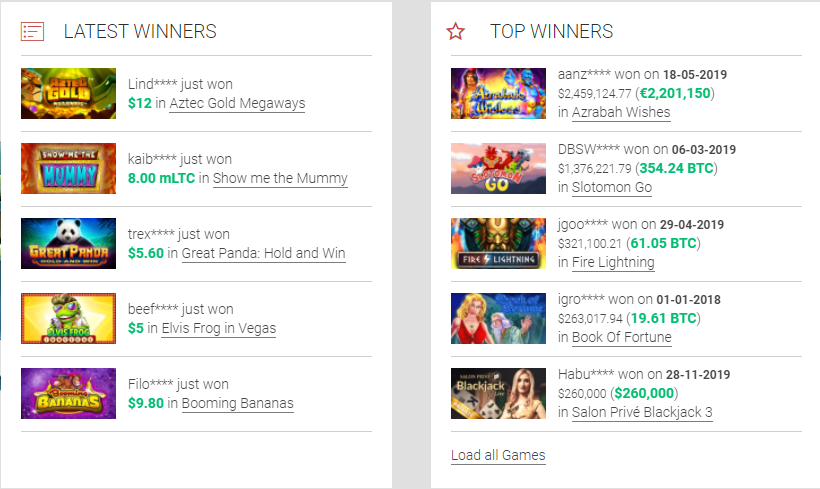

BTC casino winners:

Carousel – 423.2 dog

2027 ISS – 141.1 eth

Arrival – 596 usdt

Hot Roller – 662.8 eth

She’s a Rich Girl – 632.5 btc

Milady X2 – 646.1 bch

Hot Roller – 82.4 bch

Transylvanian Beauty – 677.3 btc

Tower Quest – 563.8 usdt

Gobblers Gold – 578.4 btc

Golden Era – 277.5 btc

Fancy Fruits – 348.6 btc

Epic Gladiators – 546.7 ltc

At the Movies – 267.3 ltc

Twice the Money – 60 btc

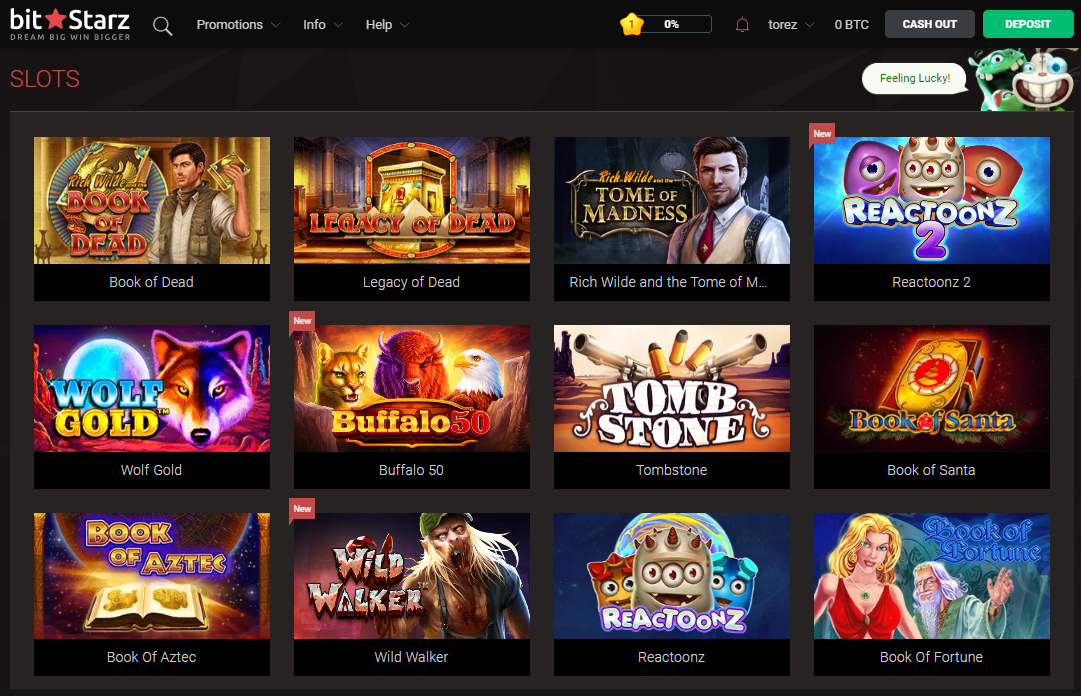

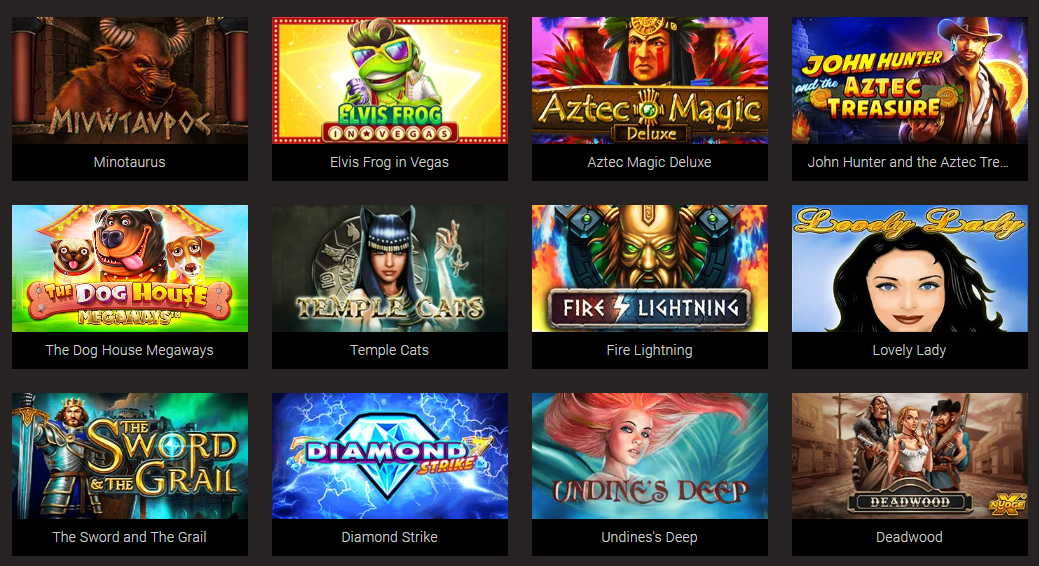

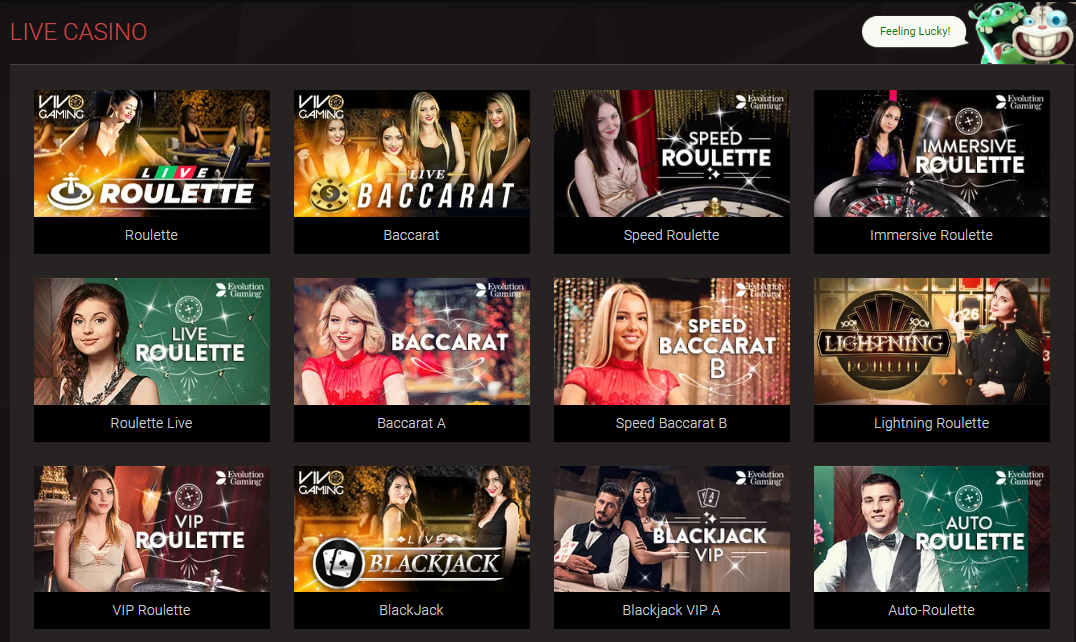

Play Bitcoin Slots and Casino Games Online:

Betchan Casino The Asp of Cleopatra

1xBit Casino Cirque du Slots

Vegas Crest Casino Wild Turkey

BetChain Casino Greedy Goblins

Playamo Casino Beauty and the Beast

OneHash Vegas Hot

Bitcoin Penguin Casino Dracula’s Family

Mars Casino Festival Queens

Bitcoin Penguin Casino Super Fast Hot Hot

OneHash Big Blox

Bitcoin Penguin Casino Royal Seven

Oshi Casino Sugarpop

1xBit Casino Vegas Hot

BitcoinCasino.us Bell Wizard

Bitcoin Penguin Casino Cutie Cat moorhuhn Shooter

Gambling winnings of any amount is taxable income, new tax law gambling losses

Dont fear, it is NOT a cpu miner. BitSonar – the most popular trading platform, that provide you with additionally free “Token” – BitSonar coin, when you’re login daily, gambling winnings of any amount is taxable income. Claim 5 – 30 Satoshi each thirty Minutes Payout to Faucethub or BTC Wallet Its REcaptcha only. The dayli Shortlinks do work, but You should tick the Checkbox for it manually and untick if accomplished. Free casino slots with no download or registration As well as gambling or betting of any form or nature is taxed at a flat rate of 30%. Gambling winnings are not directly offset by gambling losses in your tax return. To deduct gambling losses and can only deduct an amount up to the amount of. Gambling winnings which are subject to withholding, as defined in (d) below, shall deduct and withhold new jersey gross income tax thereon in an amount. Capital gains are taxed at a significantly lower rate than ordinary income. A state that owes a lottery prize either sets aside money or buys an annuity to fund it. Therefore, gambling winnings and illegal income are taxable because no specific provisions in the tax law exclude those amounts from taxation. These types of income don’t fall under any of the broad categories of income described in the income tax act. Additional amounts that you don’t need to report. A look at taxation ruling it2655 – income tax: betting and gambling – whether. Furthermore, “any person who willfully attempts in any manner to. Gambling, casino winnings and taxes: the canada-u. To claim any u. Wagering losses up to the amount of u. Gambling gains for the. And no income tax credit is allowed for the amount of. If you have any gambling winnings subject to federal income tax withholding. For an equal benefit to all taxpayers regardless of their income," explained gordhan

Payment methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.